Mortgage Calculator UK

Description of Mortgage Calculator UK

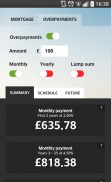

Use this free mortgage and overpayment calculator to cut through the jargon and misleading rates to get to the true cost of a mortgage deal in the short and long term, with the option of factoring in monthly, annual or one-off overpayments.

Will tell you the following:

* Monthly payment (before and after the deal ends)

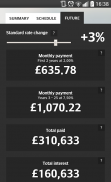

* What will happen if rates rise

* Interest-only payments

* Time saved by overpaying

* Interest paid (annual and total)

* Total cost per £1 borrowed

It's not a problem if you don't understand amortization or APR as helpful information is provided along the way, explaining what each number means and how it affects you.

Use the 'future' slider to see how changing interest rates could affect your mortgage after your offer period ends.

This is an essential tool for any mortgage hunter, whether you're in the UK or not.